You must have seen many of those TV ads which say, “Mutual Funds Sahi hai” (Mutual Funds are right), the ads which tell you that you can start investing in Mutual Funds for as low as ₹500. After watching these ads, if you have finally decided to invest, then the big question waiting for you is that “Which mutual fund should you choose?”. This blog will help you in understanding all the types of mutual funds in India, as well as which one should you choose.

You can also watch my Hindi video on the same topic if you do not wish to read

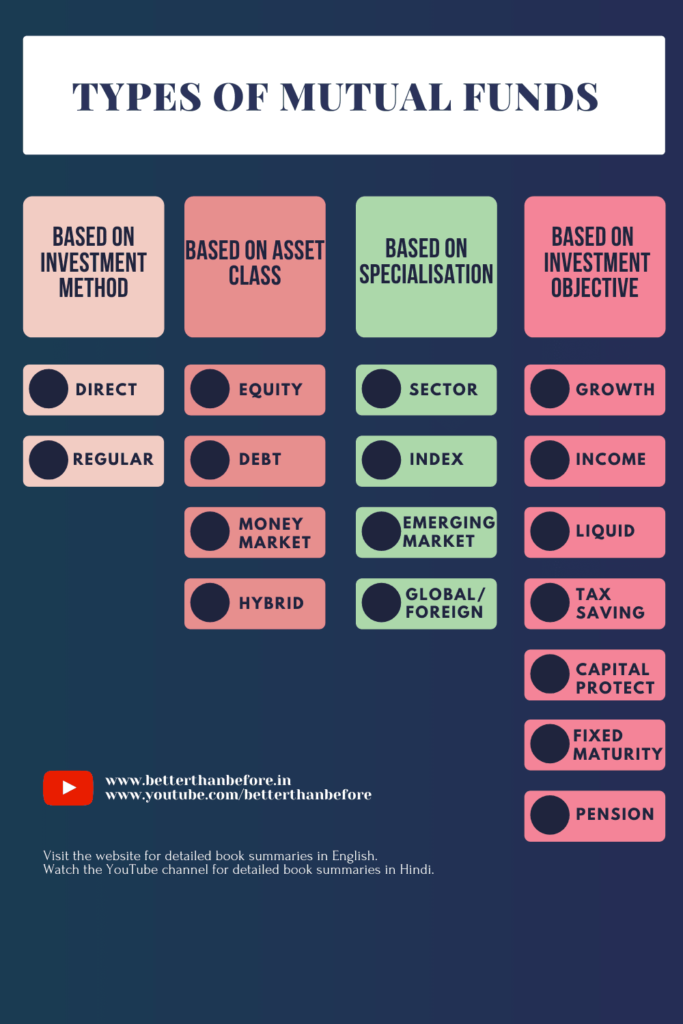

Based on Investment Method

If you differentiate mutual funds based on the method of investing, then you can divide them into two types- Direct and Regular mutual funds.

Direct Mutual Funds-

In the year 2013, the Securities and Exchange Board of India declared that everyone is allowed to invest directly in the mutual fund of his choice. Which means you can invest in any mutual fund without any need of a broker. You can do it from the comfort of your home with the help of websites and apps.

Regular Mutual Funds-

Regular mutual funds have the involvement of a broker. Due to the commission taken by the broker, you end up paying higher fees than required. Whenever you are investing through an agency, you are investing in regular funds.

I always prefer a direct investment because it has no involvement of a third-party, and it can be done from home. If you wish to invest like me, then you can download any good Mutual Fund App and start investing from anywhere, anytime.

Direct vs Regular Mutual Funds

Now you must be thinking “When people can invest directly then why do they give commissions on regular funds?”. Theoretically, when you invest in regular funds, you get investment advice from your broker. You pay for this advice. Since nobody is advising you in direct funds, you don’t have to give any fees to anybody.

Whereas, if we talk about the practical aspects, you don’t need any advice at all. All the new mutual fund apps are smarter than your broker to suggest you the best investment options. They have the real-time data of all the mutual funds in the market; they are calculating all the ratios 24×7.

Based on Asset Class:

Asset class means, “Where is your money going?” If you categorize mutual funds based on the asset class, then you can broadly divide them into 4 categories- Equity Funds, Debt Funds, Money Market Funds, and Hybrid Funds.

Equity Funds-

When you invest in equity funds, then your money goes straight into the stock market. Mutual fund houses take the money from you and then invest in various stocks. The benefit of investing in multiple stocks is that if a few stocks go down, then a few of them will also go up, and therefore your risk will be minimized.

If you further divide Equity Mutual funds then you have 3 subdivisions- Large Cap, Mid Cap, and Small Cap equity funds. Large-cap funds invest in large companies, mid-cap in medium-size companies and small-cap in small companies. It is least risky to invest in large-cap companies, riskier to invest in mid-cap companies and riskiest in small-cap companies. The profit potential is least in large-cap companies, medium in mid-cap companies and highest in small-cap companies.

Who should invest in Equity Funds?

You should invest according to your risk appetite.

Debt Funds-

When you are investing in debt funds, then you are giving your money to the mutual fund house to lend it. While investing in equity funds give you the benefits of investing in the stock market, debt funds provide you interest. It is so because, through debt funds, you are either lending your money to a few companies or to the government itself. These funds are the least risky because the price does not fluctuate like the stock market. Whatever amount you have lent, you get the interest on it.

Who should invest in debt funds?

People who are about to retire or people who cannot take the risk should invest in Debt mutual funds. You can also generate a fixed income by investing in these funds.

Money Market Funds-

The investment made in money market funds goes into instruments like treasury bills, commercial papers, repurchase agreements, etc. Instead of confusing yourself with complex terms, remember that if you want to invest for less than a year, then you can choose money market funds.

Who should invest in Money Market Funds?

People looking for low risk and return more than a bank.

Hybrid Funds-

Hybrid Funds are also known as Balanced Funds. These funds will invest one portion of your money in equity and another in debt.

Who should invest in Hybrid Funds?

People looking for risk which is lesser than equity and but more than debt can invest in Hybrid Funds.

Based on Investment Objective

If we divide mutual funds based on the investment objective, then we can put them in 8 categories- Growth Funds, Income Funds, Liquid Funds, Tax Saving Funds, Capital Protection Funds, Fixed Maturity Plans, and Pension Funds.

Growth Mutual Funds-

You will invest in growth funds when your objective is to grow your extra money into a large proportion. When you invest in growth funds, then your money goes to the sectors which have high chances of growth. Generally, you do not receive a dividend in growth funds because it is reinvested to attain exponential growth.

Who should Invest Growth Funds?

Young people with some extra money that will not be required in the immediate future.

Income Funds-

The objective of Income Funds is to create a regular stream of income. A major part of your investment goes into debt instruments so that you can receive interest in the form of income. Additionally, the amount of money which goes into the stock market is invested in stocks that give regular dividends.

Who should invest in Income Funds?

People who are retired. The money they saved throughout their lives can be invested here to generate monthly income.

Liquid Funds-

Liquid funds also invest your money in debt related instruments. The specialty of liquid funds is that you can withdraw them whenever you want. In my experience, whenever I withdraw my money from liquid funds, it takes one day for the funds to reach my bank account. The returns in liquid funds are slightly higher than saving bank account returns.

Who should invest in Liquid Funds?

If you have some extra money which you do not require for a few months then you can park it in liquid funds.

Tax Saving Funds-

As the name suggests, you can save tax by investing in these funds. They are also known as ELSS (Equity Linked Saving Scheme) Funds. The income generated through these funds is free from tax deductions. But if you invest in these funds, then you cannot withdraw your money at least for 3 years.

Who should invest in Tax Saving Funds

People who want to save some tax.

Capital Protection Funds-

Capital protection funds invest a major part of your money into debt instruments, and a very small part of it goes into equity. The objective of these funds is to provide you returns like equity funds but safety like fixed deposits. Capital protection funds come with a lock-in period of 1, 3 or 5 years.

Fixed Maturity Plans-

These funds are the alternatives of fixed deposits. They have a fixed maturity period. Additionally, you can invest your money in them during a specific period only. You cannot invest your money before the opening date or after the closing date. Also, you cannot withdraw the funds before the date of maturity. The taxes in these funds are lesser than fixed deposits.

Pension Funds-

The objective of these funds is to generate a pension after your retirement. Every month, a part of your income goes to the pension funds. You get a monthly pension after your retirement.

Who should invest in Pension Funds?

Everyone.

Specialized Mutual Funds

Specialized Mutual funds can be divided into 4 types- Sector Funds, Index Funds, Emerging Market Funds, and Global/Foreign Funds

Sector Funds-

These funds will invest your money in only one industrial sector, for example, IT Sector, Pharma Sector, Banking Sector, Real Estate Sector, etc. They are risky because sometimes the whole sector starts drowning, as you must have remembered how the whole Banking Sector plunged during PNB Scam.

Who should invest in Sector Funds?

People who are very optimistic about an industrial sector. But don’t forget that it is risky.

Index Funds-

With these funds, your money goes straight to the indexes like Nifty and Sensex. These funds are not managed by anyone. Their values go up and down as the market moves.

I prefer index funds because they are quite predictable. For example, during the elections, it was predicted by almost everyone that the Sensex will reach the 40,000 mark, and it did. I have made a profit with Index funds many times. You can also invest in indexes through ETF (Exchange Traded Funds).

Who should invest in Index Funds?

Anyone who wants to go with the market.

Emerging Market Funds-

The money invested in these funds goes to the markets of developing countries. Currently, India itself is a developing country. Other countries are investing in India through FDI, FII, P notes, etc. So as long as you are investing in the Indian market, you are investing in an emerging economy.

Global/Foreign Funds-

As the name suggests, your money gets invested globally in different countries. The objective of these funds is only to provide diversification. The risk is high in these funds, and I don’t think that you can make a considerable amount of traffic with these funds.

So these were some of the many Mutual Funds available out there in the market. I suggest you not make things complicated and invest in mainstream funds like Equity, Debt, ELSS, etc.